In an era characterized by rapid technological advancements, semiconductor manufacturing stands at the forefront of the global economy. Companies specializing in this domain have become pivotal players, supplying essential components for various sectors ranging from consumer electronics to defense systems. GlobalFoundries, a notable entity in this competitive landscape, continues to make headlines, not only for its significant role as a semiconductor foundry but also for its recent regulatory challenges involving trade practices with China. The complexities surrounding semiconductor trade are further underscored by the ongoing geopolitical tensions between the United States and China, making the dynamics of this sector both vital and controversial.

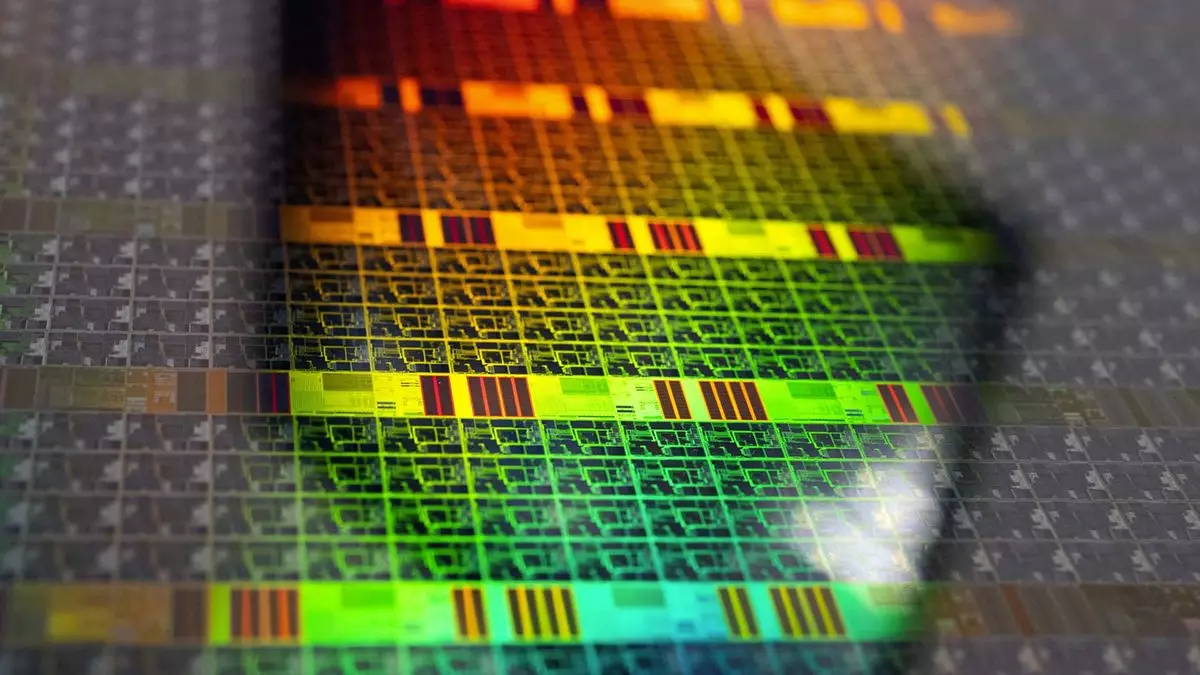

Emerging as a spin-off from AMD’s manufacturing division, GlobalFoundries has established itself as a significant contender in the semiconductor industry, claiming the position of the third-largest foundry globally by revenue. The firm caters to a diverse clientele, producing chips for an array of applications including smartphones, automotive systems, aerospace technology, and burgeoning Internet of Things (IoT) devices. With the increasing demand for chips across various sectors, GlobalFoundries has benefited immensely from legislative measures like the CHIPS Act, which promises substantial federal funding aimed at enhancing semiconductor manufacturing capabilities within the United States.

However, GlobalFoundries recently found itself in the crosshairs of regulatory scrutiny when it disclosed shipments amounting to $17 million worth of semiconductor materials to SJ Semiconductor, a Chinese firm identified as being connected to the controversial Semiconductor Manufacturing International Corporation (SMIC). This disclosure, spanning the period from February 2021 to October 2022, drew the attention of the Bureau of Industry and Security (BIS), which flagged the shipments as violations of U.S. export regulations designed to limit technology transfer to entities potentially linked to military applications. The BIS subsequently imposed a $500,000 penalty as a consequence of these breaches, highlighting the stringent landscape of compliance that semiconductor manufacturers must navigate.

The fact that GlobalFoundries voluntarily reported the breach and cooperated with the investigation is noteworthy. Such transparency may have played a role in mitigating the financial repercussions imposed by the U.S. government. The leniency observed in the fine could be interpreted as a strategic move to encourage self-reporting among companies involved in complex and often opaque supply chains. While $500,000 may seem trivial relative to the broader financial context of GlobalFoundries, it emphasizes the government’s intention to cultivate an environment where businesses adhere to compliance protocols, thereby safeguarding national security interests.

GlobalFoundries is not alone in facing the regulatory labyrinth surrounding U.S.-China trade restrictions. Reports indicate that Taiwan Semiconductor Manufacturing Company (TSMC) is currently investigating its own potential compliance issues, as some of its manufactured chips reportedly found their way into devices associated with Huawei, another entity on the U.S. entity list. This situation not only reflects the complexities within multinational supply chains but also underscores the potential for unintended breaches of compliance, even among the most established manufacturers.

As the semiconductor industry continues to evolve, so too will the regulatory landscape. Companies like GlobalFoundries and TSMC find themselves in a delicate position, balancing the need for growth and innovation with the stringent requirements set forth by government authorities. The concept of “fess up, pay less” places a spotlight on the evolving relationship between industry and regulation, calling into question how such measures will be sustained amid potential shifts in political climate following upcoming elections.

The challenges facing GlobalFoundries and the broader semiconductor industry illustrate the intricate balance between technological advancement and compliance with international trade laws. As geopolitical tensions simmer, companies within this critical sector must remain vigilant, proactively addressing potential compliance issues to foster trust and cooperation with regulators. The semiconductor industry stands at a crossroads, where innovation must be partnered with accountability, ensuring that advancements fuel not just economic growth but also secure national interests in a challenging global environment.