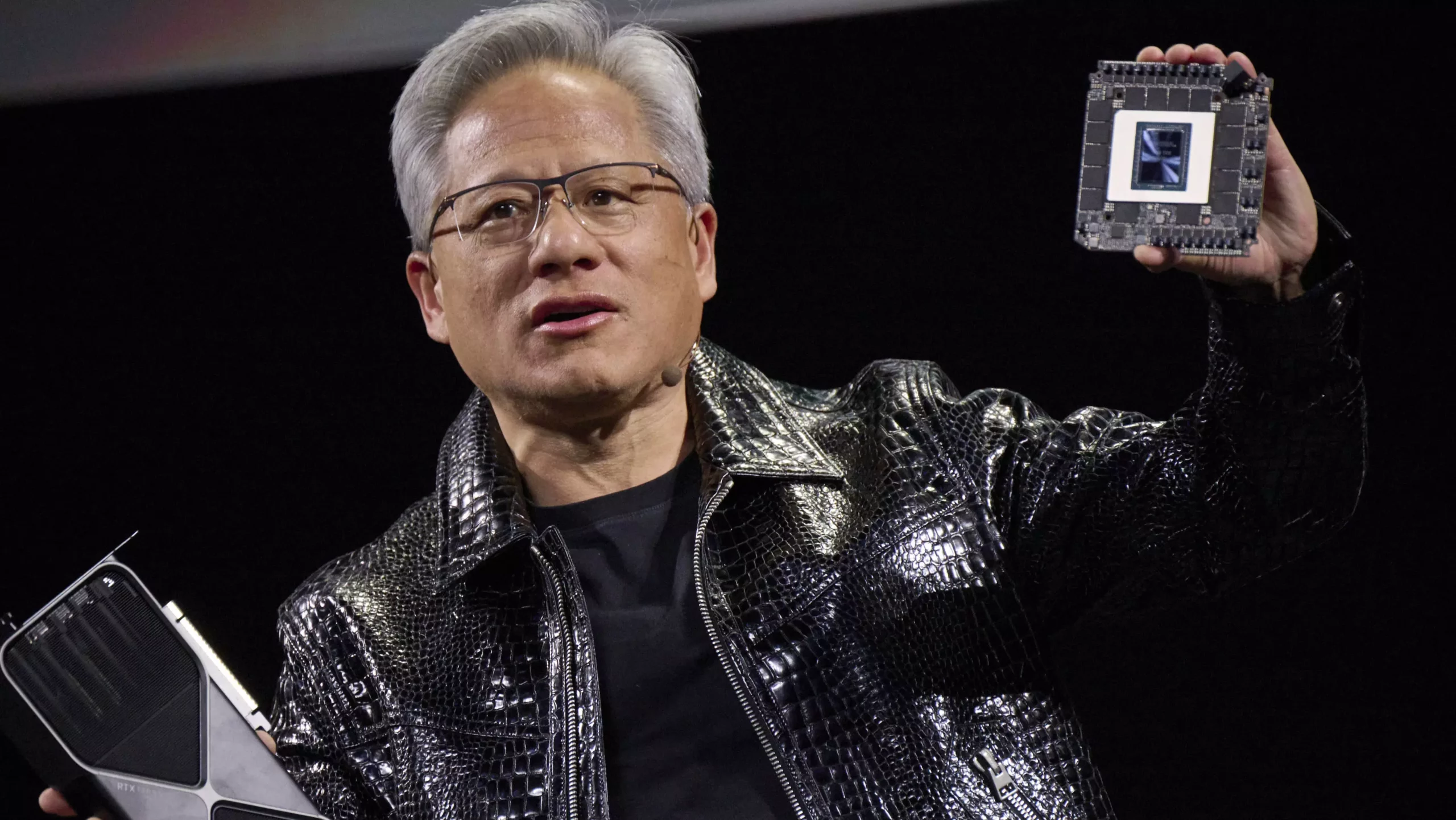

The technological landscape is shifting rapidly in response to geopolitical currents, raising critical questions about how nations like the United States navigate the fine line between advancing their economies and asserting their interests. Jensen Huang, the CEO of Nvidia, is becoming a vocal figure in this discourse, advocating for a policy shift regarding chip exports. The backdrop of his comments—a shifting political climate under an ‘America-first’ administration—highlights the tensions between global interconnectedness and national pride. The implications of this intersection are far-reaching, and they compel us to reconsider what true competitiveness means in a globally integrated marketplace.

Huang’s remarks about the potential changes to the U.S. chip export regulations echo a growing concern within the industry: how can America maintain its lead in artificial intelligence amid fierce competition, particularly from countries like China? Currently, the Diffusion rule, which proposed categorizing countries into three groups based on their eligibility to receive U.S. chips, is under scrutiny. Huang argues that the necessity for the U.S. administration to adopt a more flexible export policy is essential for keeping pace with fast-evolving AI developments worldwide. This need for change stems from the reality that technology does not respect geopolitical barriers; rather, it transcends them, making a case for a more open approach to export regulations.

AI Arms Race: The Need for Strategic Export Policies

The ongoing competition between the U.S. and China is often portrayed as an all-or-nothing affair, but Huang’s position suggests a more nuanced understanding of this rivalry. He contends that constant innovation and accelerated diffusion of AI technologies are required to compete effectively on the global stage. In reiterating, “China is not behind… they’re right behind us,” he illuminates the urgency of action in an endless race. However, the question remains: will implementing more lenient export controls effectively bolster U.S. competitiveness, or does it inadvertently risk further empowering rival nations?

Huang advocates for a regime of expedited export licensing that could theoretically enhance U.S. negotiating leverage and facilitate quicker access to markets. Nevertheless, this stance raises valid concerns, particularly regarding the inadvertent acquisition of American technology by adversaries. There is already evidence that U.S. export restrictions have not completely impeded China’s access to advanced technology, as evidenced by the routes taken through intermediaries. Hence, Huang’s appeal to liberalize export policies can be interpreted as a double-edged sword.

Questioning the Manufacturing Narrative

One of the more disconcerting aspects of Huang’s argument lies in the framing of Nvidia as a quintessentially American company. While Nvidia has made tremendous strides in the tech arena, the bulk of its production relies on Taiwanese semiconductor manufacturers, specifically TSMC. Thus, presenting Nvidia’s exports as an emblem of American manufacturing seems disingenuous at best. The tech supply chain is profoundly globalized; redefining technological success solely in terms of national identity may cloud the true nature of its globalism.

The criticism extends further when considering investments made by companies like TSMC to increase their U.S.-based production. While these efforts are commendable—and indeed necessary for enhancing U.S. competitiveness—the reality is that a significant portion of the manufacturing will remain in Taiwan for the foreseeable future. Thus, the narrative of American chips must be approached with caution, lest it oversimplify the complex interdependencies that characterize modern technology manufacturing.

The Profit Motive: Balancing Business Interests and National Strategies

At the core of this debate lies an undeniable truth: profit drives decision-making in the private sector. Huang’s support for looser export regulations can also be interpreted through the lens of corporate self-interest. More international sales mean increased revenue for Nvidia and its shareholders, which could ultimately result in greater investment in innovation, bolstering the tech ecosystem in the U.S. While this may seem beneficial from a purely economic standpoint, it presents ethical dilemmas. Should a private corporation’s profit motive dictate the pace and direction of national technological advancement?

This convergence of profit and policy raises a pivotal question: are we sacrificing long-term national security for short-term financial gain? As the tech industry evolves, the lines between innovation, strategy, and economic considerations will increasingly blur. Navigating this territory requires deliberate and thoughtful dialogue, especially as policymakers strive to understand and manage the relationship between technological sovereignty and global interdependence.

In the end, the case presented by Huang touches on vital issues that reach beyond the confines of the tech industry. The dialogue he has sparked reveals the complexities inherent in balancing national interests, corporate profit, and the race for technological supremacy. As we proceed, fostering open discussions that look beyond immediate financial benefits may serve as our best strategy for achieving sustained competitiveness and innovation.