In examining AMD’s recent financial disclosures, one cannot overlook the company’s impressive ability to capitalize on market demand and outpace industry expectations. Achieving a total revenue of $7.7 billion, representing a 32% year-over-year increase, AMD demonstrates a resilient growth trajectory that reflects strong product demand and strategic market positioning. Particularly within its Client and Gaming divisions, the company has seized opportunities brought forth by shifts in the PC and gaming industries. A 69% surge in this sector’s revenue underscores AMD’s success in appealing to both consumers and enterprises, driven by compelling Ryzen processors and Radeon graphics cards.

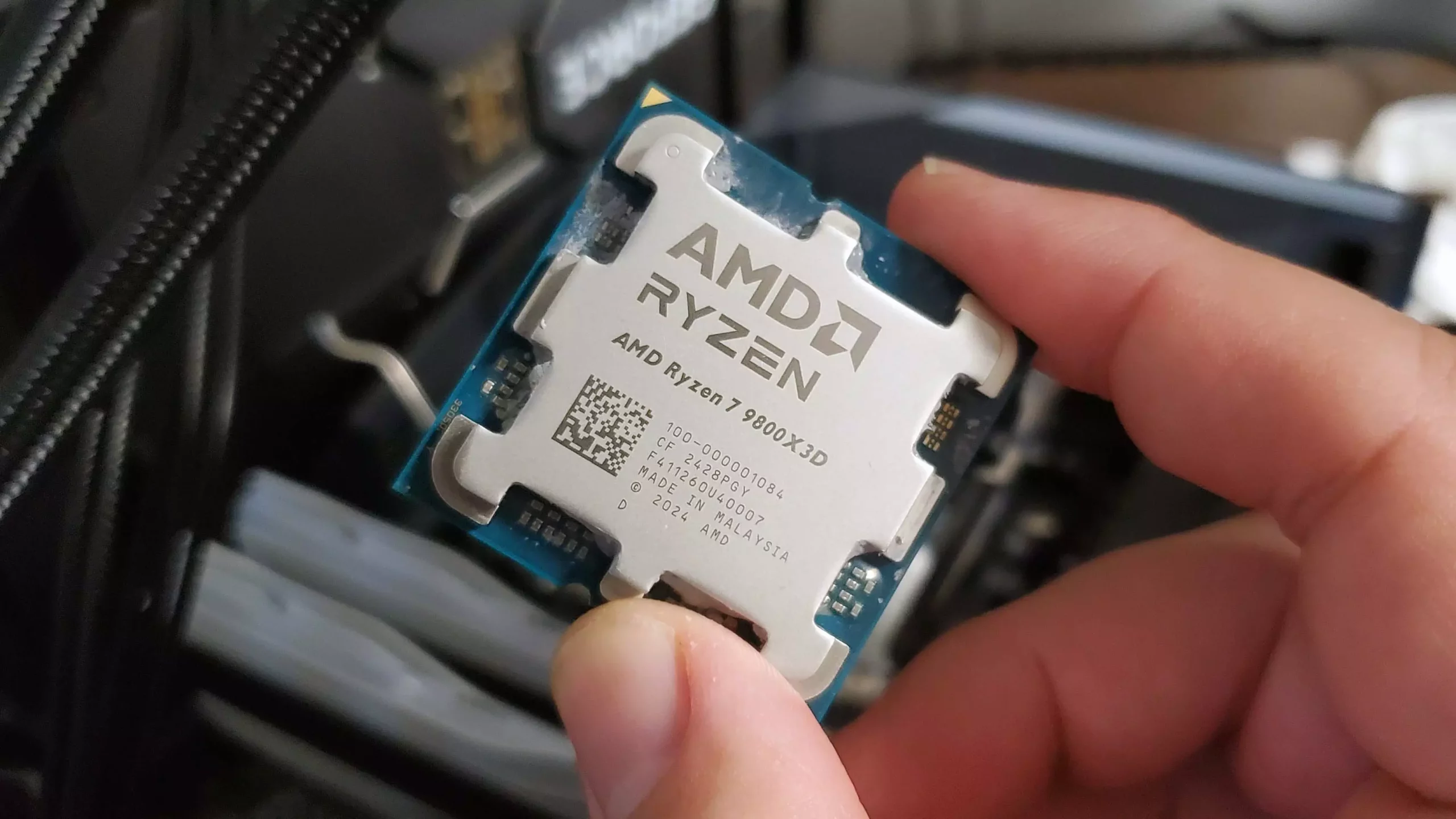

This growth isn’t merely a matter of catching the wave but showcases AMD’s capacity to innovate and adapt swiftly. The adoption of high-performance CPUs like the Ryzen 7 9800X3D and GPU offerings such as the Radeon RX 9070 XT underscores a competitive edge that’s resonating well with PC enthusiasts and casual gamers alike. Additionally, AMD’s strategic focus on OEM partnerships and the proliferation of Ryzen-powered Dell business and consumer PCs provides a diversified revenue stream that mitigates reliance on any single segment.

Importantly, AMD’s resurgence in the PC market is partly a response to setbacks faced by Intel and Qualcomm, which have stumbled over recent product releases and market confidence. The decline of Intel’s Raptor Lake and tepid reception of Arrow Lake chips has created a vacuum—one that AMD has stepped into with confidence. The willingness of OEMs and system builders to pivot toward AMD’s offerings hints at a shifting landscape, where AMD’s chip capabilities and competitive pricing are becoming increasingly appealing.

Data Center Division: Promising Yet Imperfect

While AMD’s growth narrative is compelling, a closer look at its data center division reveals nuanced challenges. The segment’s revenue increased by 14%, reaching $3.2 billion, signaling ongoing demand in enterprise and cloud markets. However, the operating loss of $155 million exposes underlying vulnerabilities, specifically heightened by external regulatory pressures. US export restrictions on AMD’s MI308 data center GPUs have imposed significant operational and financial constraints, leading to approximately $800 million in inventory-related charges.

This situation highlights a delicate balance between strategic expansion and geopolitical constraints. AMD’s inability to fully capitalize on its AI and GPU offerings in certain markets hampers expected revenue momentum, which is a departure from the typical rapid growth associated with data center hardware. Nvidia’s dominant position in this realm accentuates how challenging it is for AMD to claim substantial market share swiftly, despite incremental advances.

Indeed, the restriction-induced inventory excess underscores a potential risk for AMD’s longer-term outlook. Yet, the company remains optimistic, projecting Q3 revenues of $8.6 billion, buoyed by potential reinstatement of export privileges in China and strong demand for AI-powered chips. This outlook suggests AMD’s leadership views these hurdles as temporary, trusting in its innovation pipeline and strategic alliances to turn current setbacks into future growth drivers.

Market Dynamics and Future Outlook: A Tense Yet Optimistic Path

The stock market’s reaction to AMD’s quarterly results, with a slight dip in share prices, exemplifies the complex perceptions investors hold towards tech giants navigating geopolitical and competitive landscapes. While the company’s core business remains robust, external factors such as export restrictions and competitive pressures from Nvidia weigh heavily on market sentiment.

Despite this, AMD’s unwavering confidence in future earnings highlights a disciplined belief in its strategic initiatives. The push to expand into AI chip sales—especially if regulatory restrictions ease—could be transformative. The company’s ability to secure new contracts and penetrate markets previously dominated by other semiconductor giants indicates a growing influence in the chip industry.

Furthermore, AMD’s focus on innovation and partnership development positions it to challenge incumbent dominance more aggressively. Its investments in chiplet technology and multi-core architectures, along with increased R&D expenditures, reflect an understanding that sustained growth depends on technological leadership.

AMD’s recent financial results paint a portrait of a company that, despite facing significant external hurdles, has harnessed its core strengths to propel forward. Its ability to win over OEMs, grow its gaming footprint, and pursue opportunities in the AI domain demonstrate a strategic resilience that could redefine its position in the semiconductor industry for years to come.