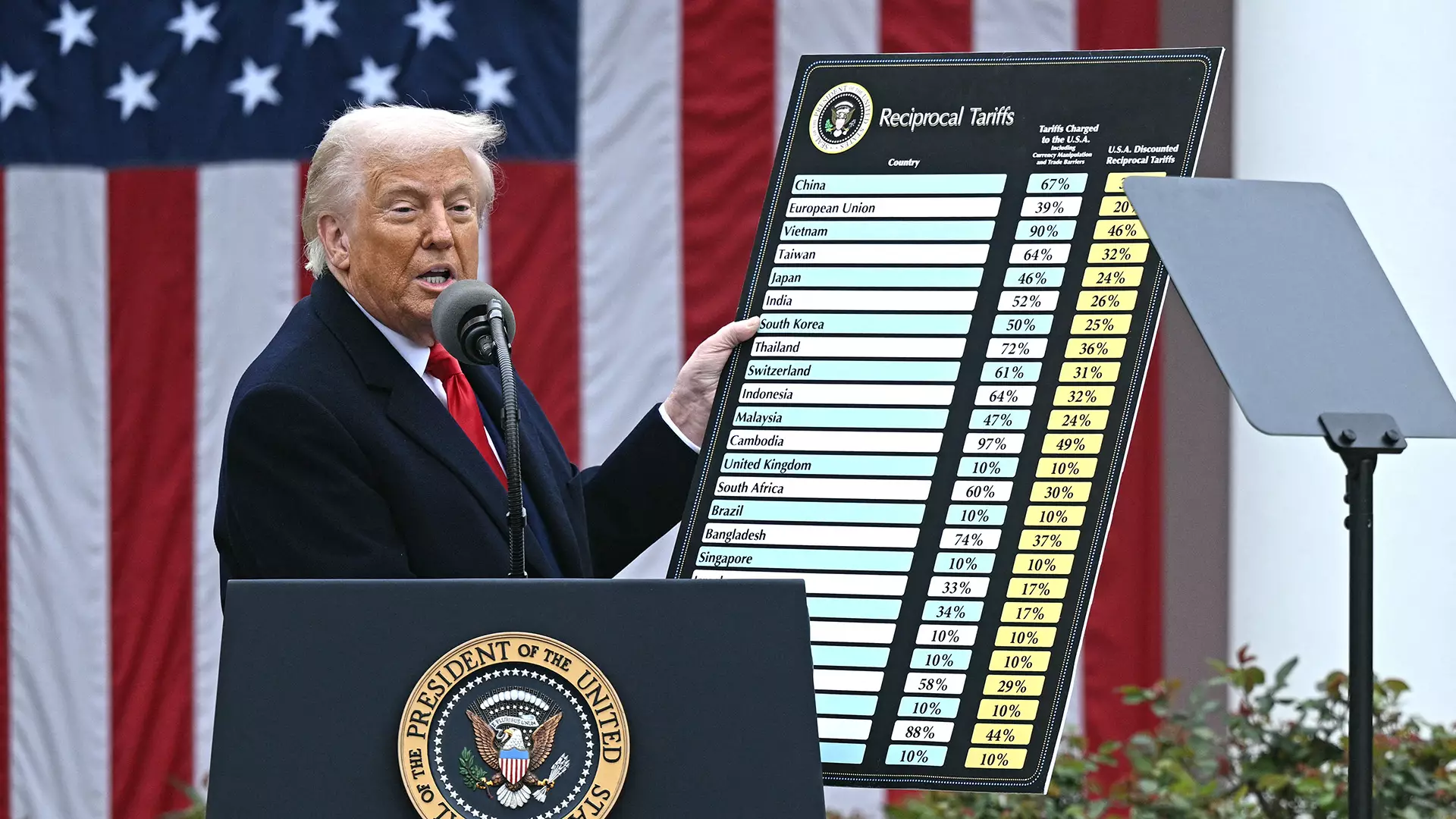

In recent years, tariffs have become more than just a tool for protecting domestic industries—they are a reflection of geopolitical tensions, economic strategy, and national security priorities. The recent announcement by President Donald Trump to impose reciprocal tariffs on multiple nations underscores an increasingly assertive stance toward international trade. While the proclaimed aim is to safeguard American economic interests, the broader implications reveal a complex dance of retaliation, diplomacy, and economic resilience. This move, purportedly driven by the desire to correct perceived trade imbalances, paints a picture of a nation willing to leverage its tariffs not merely as economic instruments but as geopolitical chess pieces. The shift towards reciprocal tariffs signifies a strategic attempt to reshape the global trade landscape, emphasizing national sovereignty over free-market principles.

What’s particularly striking in this scenario is the selective nature of exemptions—Malaysia’s pharmaceutical and semiconductor sectors, for instance, are spared, yet Taiwan, a key player in semiconductor manufacturing, faces punitive measures. This disparity highlights the tangled web of international alliances, economic dependencies, and strategic interests that influence tariff policies. The decision to target Taiwan, renowned for its critical role in global chip supply chains, is a high-stakes gamble, risking further diplomatic tensions while potentially disrupting the delicate balance of the semiconductor industry. Such moves are likely to ripple across markets, affecting supply chains, consumer prices, and technological advancements—factors that influence both national security and economic competitiveness.

The Dual-Edged Sword of Protectionism and Technological Sovereignty

The recent tariffs are more than mere economic retribution; they represent a broader push towards technological independence. By incentivizing domestic production, especially in cutting-edge sectors like semiconductors, the US aims to reduce reliance on foreign supply chains prone to geopolitical risks. TSMC and Samsung’s ongoing investments within American borders underscore this ambition. TSMC’s construction of advanced fabrication plants in Arizona and Samsung’s facilities indicate a strategic move to localize high-tech manufacturing and mitigate vulnerabilities associated with global supply disruptions. However, these investments, while promising, can hardly bridge the gap between current demand and future needs. Despite increased domestic capacity, the global demand for semiconductors—especially for gaming hardware, mobile devices, and critical infrastructure—remains far higher than what new US-based facilities can produce initially.

This tension between protectionism and international collaboration reveals the limitations of relying solely on tariffs to foster technological sovereignty. High tariffs might encourage local manufacturing, but they also risk increasing costs for consumers and industries that depend on affordable imports. For hardware manufacturers and gamers alike, this means potential price hikes and supply shortages in the near future. The debate over exemptions for specific sectors, such as semiconductors, further complicates this landscape. While provisional tariffs aim to give room for negotiations—particularly with Taiwan—the threat of higher tariffs on foreign-made chips signals a shift towards more aggressive economic nationalism. This approach raises fundamental questions about the balance between protecting domestic industries and maintaining a vibrant, interconnected global economy.

Strategic Retaliation or Self-Inflicted Wounds?

The decision to impose these tariffs is undeniably rooted in a desire to correct trade imbalances, but their effectiveness remains a matter of debate. Historically, tariffs have often led to retaliatory measures that escalate into trade conflicts, harming consumers and industries in the process. The fluctuation of tariff rates, as seen in the provisional 20% on Taiwan, exemplifies a strategy that is as unpredictable as it is aggressive. This uncertainty hampers planning and investment for companies operating in affected sectors, especially tech giants and component manufacturers.

Furthermore, the collateral damage extends beyond economic effects. Diplomatic relationships are strained, and global alliances are tested as nations respond to perceived aggression. The intricate web of international trade agreements, diplomatic negotiations, and economic dependencies means that the US’s move could trigger a domino effect—forcing allies and adversaries alike to adjust their trade policies. While some argue that tariffs can serve as leverage to renegotiate more favorable terms, they also risk provoking an isolated economic stance that stifles innovation and global cooperation.

In this high-stakes arena, the core challenge is whether tariffs will serve as catalysts for positive change—prompting nations to level the playing field—or whether they will become instruments of economic protectionism that ultimately undermine the very innovation and growth they intend to promote. As the global economy navigates these turbulent waters, it’s clear that strategic patience, diplomatic engagement, and forward-looking economic policies will be critical in shaping a sustainable future in trade and technology.